33+ deducting home mortgage interest

In Turbo Tax it says standard deduction is best ignoring the interest amount. Home improvements required for.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Interest on up to 100000 borrowed as a home equity loan or line of credit.

. As a landlord you can. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Most homeowners can deduct all of their mortgage interest.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web First time home owner And Self employed so itemized write offs. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

You may deduct up to 10000 5000 if married filing separately for a combination of property taxes and either state and local income taxes or. Web Whether single or married you cant deduct mortgage interest on three houses. Web Fortunately you can deduct your mortgage interest as an expense on your Schedule E to lower your rental income and reduce your tax bill.

Ad Get The Service You Deserve With The Mortgage Lender You Trust. Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. However higher limitations 1 million 500000 if married.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad 10 Best House Loan Lenders Compared Reviewed. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Ad Get The Service You Deserve With The Mortgage Lender You Trust. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. 750000 if the loan was finalized after Dec.

I thought Interest can be written off. What More Could You Need. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web Freddie Mac. But if you rent the third home heres what you can do.

Get Your Estimate Today. Web This benefit also has income requirements. Homeowners who bought houses before December 16 2017 can.

Web Generally yes. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Lock Your Rate Today.

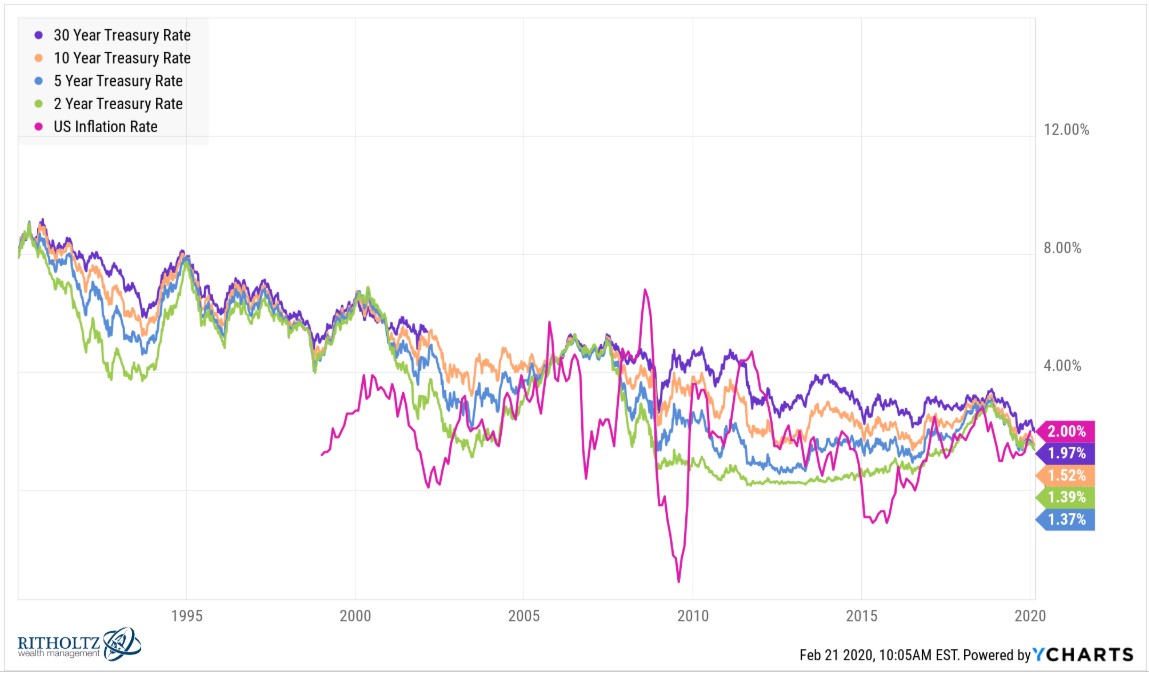

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. If you are single or married and. Forecasts the average 30-year mortgage to start at 66 in Q1 2023 and end at 62 in Q4 2023.

Comparisons Trusted by 55000000. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Get Your Estimate Today.

If you took out your home loan before. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. What More Could You Need.

:max_bytes(150000):strip_icc()/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

Mortgage Interest Deduction

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

Member Benefits Program Insurance The Florida Bar

Liquid Swap 4 0 Behind The New Look And Feel Binance Blog

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Betterment Resources Original Content By Financial Experts

How Much Money Do I Get In Hand For Ctc Of 33 Lakh Inr Quora

Free 33 Sample Free Assessment Forms In Ms Word Pdf Excel

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

How To Optimize Your Mortgage Under The New Tax Law Aspiriant

The Home Mortgage Interest Deduction Lendingtree

Should You Pay Off Your Mortgage Early With Rates So Low

How To Spend Newcastle S 200m Budget On Fm22 Realistic Raid Or Galacticos 2 0 Football Manager

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service